Hospitality Insight

Rate adjustment due to wage agreement increases

July 2025

Are there limits?

It is important to consider these wage increases both in the context of the past years (inflation) and also to recognize that inflation is already factored into these increases. Moreover, it is also understandable that an appropriate wage increases the attractiveness of the industry.

Nevertheless, wage costs are often among the largest cost factors for hotels and, alongside other rising costs, contribute significantly to the financial pressure on businesses. This is reflected, among other things, in the approximately 1,200 insolvencies expected in the gastronomy sector in 2024, according to the information service provider CRIF.

Unfortunately, no more recent data is available at this time. However, a clear pressure following the pandemic can be observed.

In light of these facts, the question arises: What alternatives are available to businesses to avoid imminent insolvency?

Depending on the segment and stage of development, as already mentioned, various process optimization strategies offer potential solutions (e.g., self-check-in, digital concierge, in-room voice assistance, more efficient PMS systems and revenue management processes, etc.).

Especially in labor-intensive operations such as luxury hotels, there is still partially untapped potential in the area of digitalization. In the higher segments in particular, the challenge lies in aligning digitalization with the high demand for personal service. However, the necessity of personal interactions is increasingly being questioned, even in luxury hospitality (Personal note: Please don’t!). In operations such as limited-service hotels, where this dynamic plays a less significant role, digital possibilities are already, or at least partially and depending on the brand’s development stage, highly advanced. In such cases, or when financial resources for alternative investments are not available, a price increase often remains one of the last remaining alternatives.

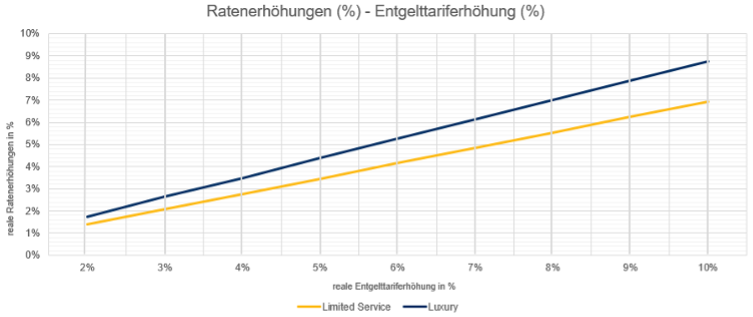

The following figure shows the required real percentage increase in average room rates of limited-service hotels (upper-midscale segment) and luxury hotels in relation to the real percentage increase in collectively agreed wages, in order to achieve the same profit. The assumption is that other revenue and cost groups remain proportionally the same in relation to total revenue.

In order to achieve the same operating result, the business would therefore have to increase its room rate, on average, by 0.7 percent in limited-service hotels and by 0.9 percent in luxury hotels for every one percent increase in real wage costs.

Assuming an inflation rate of 2.5 percent, for example, a Moxy Hotel in Dortmund (North Rhine-Westphalia, 10.5 percent nominal increase) would have to increase its real average rate from 90 euros this year to around 97 euros (plus 8 percent) next year and to 105 euros (plus 8 percent) the year after – assuming demand and other costs remain proportionally stable, which they do not. A luxury hotel in Brandenburg would thus need to increase its rate from an average of 368 euros this year to around 388 euros (plus 5.5 percent) next year and to 409 euros (plus 5.5 percent) the following year.

Considering this calculated example of a classic economic wage-price spiral in an overall stagnating economy, and the widespread industry view that the ‘price increase strategy’ in ‘100-euro-country Germany’ is soon – if not already – reaching its limits, it seems likely that this strategy is losing its effectiveness.

In my opinion – despite my still somewhat young and at times foggy crystal ball – this is rather unlikely. Rate increases are (warning: boring answer) to be assessed in the context of product, location, concept and, above all, market segment and price level (luxury or budget). It is clear that budget to midscale operations will have to approach the issue more cautiously and sensitively due to their more price-sensitive clientele than luxury hotels, although in theory, experience-enhancing diversification features can certainly justify a price increase even in this segment. But 2 percent of a 90-euro rate is not the same as 2 percent of a 300-euro rate, and therefore wage cost increases should not be underestimated even in luxury hospitality. Furthermore, it must be noted that limited-service concepts generally have fewer staff, and the wage increases therefore have a comparatively smaller impact. Nevertheless, the question of continuous improvement of GOP (gross operating profit) remains open here, and distribution and/or service and energy costs are increasingly coming into focus in cost management.

What’s your take on this? What are your experiences?

And can you imagine increasing your rate by 5 to 15 percent (or even more) in two years due to rising costs without losing too much demand? And if this whole topic gives you no headaches at all – then I wish you a good night’s sleep.