Local roots, global scale: five key drivers of management company consolidation

January 2026

From hot markets to a hotter M&A pipeline

The post COVID recovery did more than repair the U.S. hotel industry – it reshaped where value is being created and who is best positioned to capture it.

Nowhere is that clearer than in the Sunbelt and its collar markets, where demographic shifts, corporate relocations and “year round leisure” have combined to produce outsized and often resilient hotel performance.

Florida is the most vivid example. Recent analysis of major markets across the state shows a cluster of high‑performing lodging markets—Orlando, Tampa and Palm Beach at the very top, with Naples, Miami, Sarasota and Jacksonville not far behind. Together they form a statewide lattice of strong RevPAR, rate growth and diversified demand, from global tourism to healthcare, logistics, finance and education.

For management companies, that kind of performance doesn’t just look attractive—it creates urgency. Owners in these markets want sophisticated support, brands want consistency and local labor dynamics are complex. National and global platforms see an opportunity, but they also see a barrier: much of the best‑located branded inventory is already operated by regional or boutique firms with deep local roots.

That tension—between global ambition and local incumbency—is what’s driving today’s consolidation wave.

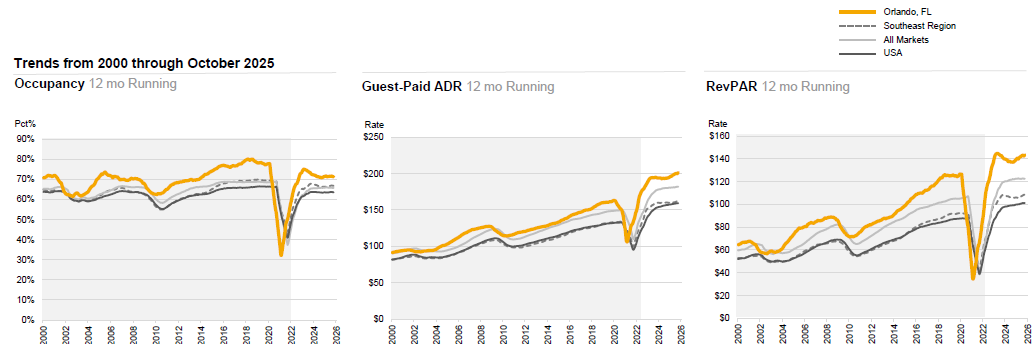

Orlando, FL: Example Stellar Market Performance Ranking

Source: Costar, Horwath HTL

Source: Costar, Horwath HTL

The Five Key Drivers of Consolidation

While every deal has its own story, the same themes appear again and again in management‑company M&A. In our work with both buyers and sellers, five drivers show up most consistently:

- Local market knowledge and relationships

- Speed to scale and regional density

- Access to talent and service culture

- Rising expectations for technology and sophistication

- Capital strategies and exit planning

Each of these speaks to a simple reality: it is no longer enough for a management company to be big, and it is no longer enough to be local. The future belongs to firms that can be both.

Local Knowledge and Relationships

In the Southeast and Florida especially, the most durable advantage a management company can hold is local understanding. That can mean:

- Knowing how a hospital expansion will affect compression on specific nights.

- Understanding which military exercises will quietly fill midweek shoulder periods.

- Recognizing how a theme park’s seasonal calendar or a cruise deployment will bend demand patterns.

Local operators in markets like Orlando, Tampa, Palm Beach, Naples, Miami and Jacksonville have built this knowledge over years and through multiple cycles. They also tend to have longstanding relationships with owners, lenders, civic leaders and local employers.

For larger platforms looking to enter or deepen their presence in these markets, acquiring that knowledge—as well as the people who hold it—is often more realistic than trying to re‑create it from afar.

Speed to Scale and Regional Density

Scale has always mattered in management, but the definition of “scale” has shifted. Today, the most valuable scale is not just national; it’s regional and sub‑regional density.

In the collar markets of the Southeast and throughout Florida’s secondary and tertiary cities, it’s density that allows operators to:

- Cluster revenue management and sales teams.

- Share engineering, HR and training resources across multiple hotels.

- Build brand‑agnostic operating playbooks that still reflect local realities.

Without enough hotels in a region, these investments are hard to justify. Acquiring a regional platform with 10–30 contracts in the right places—especially high‑performing Sunbelt and Florida markets—gives a buyer immediate density and the ability to operate as a true local player, not a remote brand custodian.

Talent and Service Culture

Labor is now one of the defining challenges of hotel performance, and it is intensely local. Wage expectations, commute patterns, cultural norms around schedules and second jobs—all of these vary by neighborhood, not just by city.

Boutique and regional management companies often excel here. Their leaders are physically present. Their general managers are known in the community. Their HR practices have evolved to fit local realities.

Buyers increasingly value these “soft” assets as much as contract lists. In many deals, the most important part of due diligence is not the P&L of each hotel, but the depth and stability of the local leadership bench. When those leaders are retained, the combined platform gains both capacity and credibility in the markets where it matters most.

Rising Expectations: Technology, Reporting and Brand Interfaces

At the same time, owners and brands are asking more of management companies than ever before. Sophisticated revenue management, forecasting, business‑intelligence dashboards, digital marketing, centralized procurement and cross‑brand reporting are becoming baseline expectations.

For smaller operators, the cost and complexity of building and maintaining these capabilities can be daunting. For larger operators, M&A offers a way to roll those capabilities out across additional fee streams quickly.

The result is a natural trade: boutique and regional platforms bring contracts, relationships and local know‑how; large platforms bring tools, systems and specialized teams. Together, they can deliver something that neither could easily achieve alone: high‑touch, locally attuned service backed by institutional‑grade infrastructure.

Capital, Risk and Exit Strategies

Finally, consolidation is being pushed along by capital markets themselves. Investors—particularly private equity and family offices—see management platforms as attractive vehicles for:

- Diversifying exposure across brands, markets and chain scales

- Capturing fee income tied to both current cash flows and future growth

- Building a coherent story for an eventual sale or recapitalization

For founder‑led regional management companies, this creates options. They can:

- Use a sale or merger to solve succession planning.

- Take some chips off the table while rolling equity into a larger platform.

- Gain access to capital that allows them to grow beyond their current geographic footprint.

In Sunbelt and Florida markets where performance is visibly strong on platforms like MarketCompass, these conversations are happening more often and with more urgency.

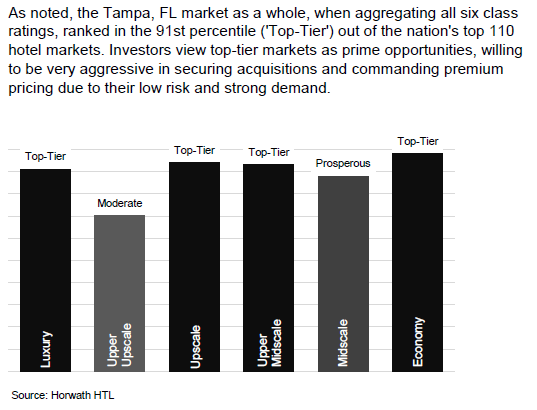

Tampa, FL: Example Stellar Clas Performance Ranking

What Recent Deals Tell Us

Several recent transactions illustrate how these drivers play out in practice.

- When Aimbridge Hospitality acquired Prism Hotels & Resorts, the strategic fit extended beyond incremental unit count. Prism brought a reputation for complex turnarounds and a portfolio with significant presence in Sunbelt markets. The deal’s real value lay in combining Prism’s specialized skills and relationships with Aimbridge’s scale, technology and brand breadth.

- The merger of Benchmark and Pyramid created a platform with deep resort, lifestyle and full‑service expertise and a far wider geographic footprint. Each side contributed different strengths—luxury and experiential on one hand, broad branded and independent capabilities on the other—creating a more diversified, resilient operator.

- Remington Hotels’ acquisition of Chesapeake Hospitality broadened its reach across the Eastern U.S. and deepened its presence in secondary and tertiary markets. It also added a portfolio of owner relationships and local teams that would have taken years to build organically.

- Raines’ acquisition of HP Hotels is a clear example of collar‑market logic at work. Raines, already strong in the Carolinas and along parts of the Southeast coast, gained immediate density in markets across Alabama, Arkansas, Louisiana, Oklahoma and Texas. HP Hotels’ leadership and teams brought exactly what Raines needed to grow: people who knew the local labor markets, demand drivers and owner expectations.

In each case, the headline was scale, but the substance was local: who knows these markets best, and how do we keep them engaged in the combined platform?

What This Means for Regional and Boutique Managers

For regional and boutique management companies—particularly those anchored in strong Sunbelt and Florida markets—this environment represents both an opportunity and a strategic crossroads.

On the opportunity side, strong market performance and durable owner relationships make these firms highly attractive acquisition or partnership targets. On the strategic side, leadership teams are asking themselves hard questions about their future:

- Do we remain independent specialists and selectively plug into larger systems where it helps?

- Do we seek a capital or operating partner to accelerate our growth while preserving our culture?

- Do we structure a sale or merger that secures our people, our owners and our legacy?

There is no one right answer. The most successful outcomes we see are the ones where both sides are honest about what they bring to the table—and intentional about what must not be lost in the process.

Looking Ahead

The forces behind management‑company consolidation are not going away. If anything, they are likely to intensify as:

- Sunbelt and Florida markets continue to attract residents, visitors and investment.

- Brands ratchet up expectations around consistency and sophistication.

- Labor markets remain tight, uneven and deeply local.

- Capital looks for scalable, defensible platforms tied to real underlying demand.

In that context, the central challenge for hotel management companies is to balance local roots with global scale. The firms that thrive will be those that:

- Respect and retain local knowledge rather than overrunning it

- Use scale to support, not replace, on‑the‑ground leadership

- Align capital, systems and people around long‑term performance, not just short‑term optics

Many of the same dynamics are already visible—and in some cases amplified—in CALA markets, where local labor conditions, demand drivers, tax regimes and political environments can vary dramatically within a single region. The lesson on both sides of the Gulf is similar: in hotel management today, consolidation on its own is not a strategy. Consolidation that preserves and elevates local expertise is.