Hospitality Insight

How macroeconomic volatility and AI are redefining hotel financing and investment in Spain

November 2025

The Spanish hotel sector faces a challenging cycle where financial and operational decisions must align with a volatile macroeconomic context and an unprecedented technological transformation.

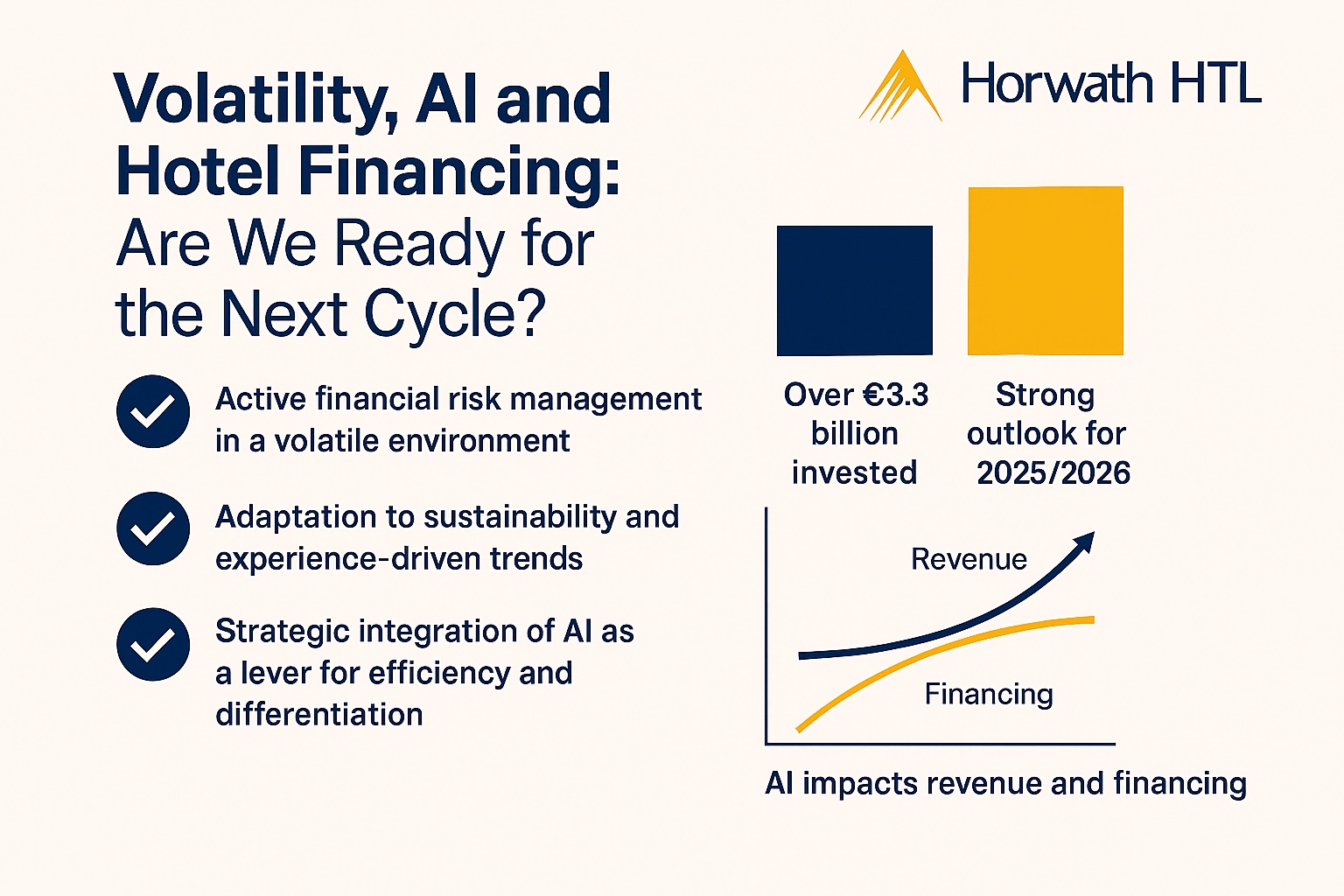

After a record-breaking 2024 with over €3.3 billion invested and landmark deals consolidating Spain as one of Europe’s most attractive markets, the 2026 horizon demands advanced strategic insight. The combination of persistent inflation, an inverted yield curve, monetary policy divergence between the ECB and the Fed, and the rise of artificial intelligence is reshaping how investments are structured, assets financed, and risks managed.

Hotel transactions remain dynamic: in 2024, 151 deals were closed involving more than 18,500 rooms, led by Madrid and the Canary Islands. Investment volume in 2025 is expected to approach €3 billion, confirming market resilience. A clear polarisation is emerging: urban assets continue to attract institutional capital, while the leisure segment regains prominence with iconic transactions such as Mare Nostrum Resort for €430 million.

This scenario drives more sophisticated structures: joint ventures, adoption of Anglo-Saxon models, and greater involvement of sovereign funds. For decision-makers, this means assessing not only entry price but also asset resilience across cycles and its ability to generate stable cash flows under margin pressure.

Demand is evolving towards concepts integrating sustainability, technology, and experience. Green hotels and ESG criteria are consolidating as critical valuation factors, while smart hotels incorporate automation, multimodal AI, and extreme personalisation. Wellness and local experiences become key value drivers, and hybrid and multi-ownership models enable income diversification and reduce exposure to seasonality. These trends are not merely operational: they directly impact financial underwriting, RevPAR estimation, and cash flow projections underpinning debt structures.

Meanwhile, the macroeconomic environment shapes capital strategy. The ECB projects inflation at 2.1% in 2025 and 1.7% in 2026, with official rates around 2%-2.15% after gradual cuts, while Euribor stabilises at 2.2%-2.25%, reflecting a normalisation of financing costs after the tightening cycle, though still above pre-2022 lows. The Fed, more cautious due to persistent core inflation, prolongs divergence between markets. The inverted yield curve signals slowdown and recession risk, affecting asset valuation and cost of capital. For investors, this means revisiting hedging strategies, stress-testing DSCR, and renegotiating covenants to avoid liquidity gaps.

Financing is being reconfigured: traditional banks tighten conditions, while private debt gains traction for its flexibility and speed, especially in refinancings and capex. Hybrid structures combining mezzanine and equity consolidate as tools to optimise leverage without compromising solvency. In this context, active financial risk management becomes a priority: interest rate hedging through swaps and caps, covenant reviews under RevPAR decline scenarios, and dynamic LTV analysis to preserve refinancing capacity.

AI drives structural shift

However, the true structural shift comes from artificial intelligence, which not only optimises operations but redefines the hotel business model. AI enables process automation, predictive maintenance, and intelligent energy management, reducing costs and improving margins. In distribution, dynamic pricing algorithms and extreme personalisation in booking engines transform demand capture, while virtual assistants and real-time sentiment analysis elevate guest experience. Strategically, AI applied to revenue management, forecasting, and financial scenario simulation provides a decisive advantage in decision-making, allowing anticipation of demand shocks and real-time adjustment of pricing and capital strategies. Its financial impact is tangible: improved GOP, increased leverage capacity, and optimised ratios such as DSCR and LTV, strengthening negotiating power with lenders.

In short, Spain will remain an attractive market, but success will depend on integrating three vectors: active financial risk management in a context of normalised yet volatile rates, adaptation to new accommodation and sustainability trends, and strategic incorporation of artificial intelligence as a lever for efficiency and differentiation.

Decisions made today on capital structure, risk coverage, and technology adoption will define competitiveness in the next cycle. In an environment where speed of response and hyper-personalisation are key, the combination of innovation, financial strength, and strategic vision will separate market leaders from followers.