Introduction

The substantial expansion of the short-term rental (STR) market, driven by online booking platforms has faced significant backlash in recent years.

This is especially true in traditionally tourism-focused destinations, where the uncontrolled growth of STRs imposes increasing challenges in environmental, social and economic contexts. Consequently, managing STR’s growth has become a widely discussed topic among governments and destination managers who seek solutions to minimise the unquestionable negative effects.

The first step in developing effective management strategies for STRs is to measure their current state through revenues, supply and demand. This report comprehensively explores the current situation of the STR market in Europe from two perspectives – the country level and the capital city level

Partner

Short-Term Rental Analytics & Data

Short-term rentals have transformed cities over the last decade

European cities are thriving. Some more than others.

Huge growth. In 2023, the STR market across the EU-27 capitals, along with Bern and London, generated a remarkable EUR 3.9 billion in gross market revenue.

This marks a 28% increase from pre-pandemic levels.

Average capital city revenue is €135 Million.

Amsterdam and Dublin recorded 41% and 35% decrease in gross market revenue.

City vs Country. The average STR revenue increase in cities (28%) lags behind the country increase (72%).

On average 32% of a countries revenue from STR’s comes from cities.

Despite regulatory pressures in certain markets, the continued growth of STRs signals a strong consumer preference for this type of accommodation.

A tale of six cities. London, Paris, Rome, Lisbon, Madrid, and Vienna – together account for 70% of the total STR revenue in 2023.

STRs are becoming increasingly profitable ventures for property owners and investors

London Share of the City Market 2023

Lisbon STR occupancy 2023

Capital City Occupancy Increase 2019-2023

What is driving the anger?

Accommodation capacity is down. Only four markets increased capacity since 2019. Valetta, Warsaw, Luxembourg and Bucharest.

All other markets fell, some falling by a lot. Amsterdam, Berlin and Dublin all fell by around 50%

As a result, density dropped overall. Density per population fell 12% or 22% if we exclude Valletta.

We have fewer properties than 2019 so why are people so angry?

Supply

Less properties…

First the good news, if you are someone living in a destination that feels like it is creaking under the weight of tourism.

The number of properties and rooms available to rent has actually decreased quite significantly since 2019.

In some of the key markets like London, Paris and Amsterdam we are looking at decreases of 24%, 60% and 7%.

In fact, only four markets out of 27 actually increased numbers and they were very low to begin with.

When we look at density, the story is the same which makes sense. The numbers of available properties per person and square kilometre has gone down precipitously.

So why is this not having an effect on local sentiment?

Demand

But more people

The answer is found on the other side of the column. Demand. The number of available properties has gone down significantly, but that has not stopped people coming.

The really interesting thing is that there is a divergence in the city vs country statistics.

Country demand has gone up enormously. France is up 31% for instance and yet demand in Paris has gone down, negative 7%. This pattern is followed throughout the rest of the countries and throws up some interesting scenarios.

This can mean a number of things. Firstly, people are coming to countries, but have already started leaving the cities and exploring more. It can also mean that people are staying outside of cities and only visiting as day trips instead. When you look at the huge rise in rates, this makes more sense.

Increase in arrivals

Barcelona: 2020: 1.9 Million 2023: 8.2 Million

Amsterdam: 2020: 3 Million 2023: 8.8 Million

Lisbon: 2020 2.4 Million 2023: 8.1 Million

London: 2020: 3.7 Million 2023: 20.3 Million

Rome: 2020: 2.6 Million 2023: 10.1 Million

source: GlobaData

How much do cities matter?

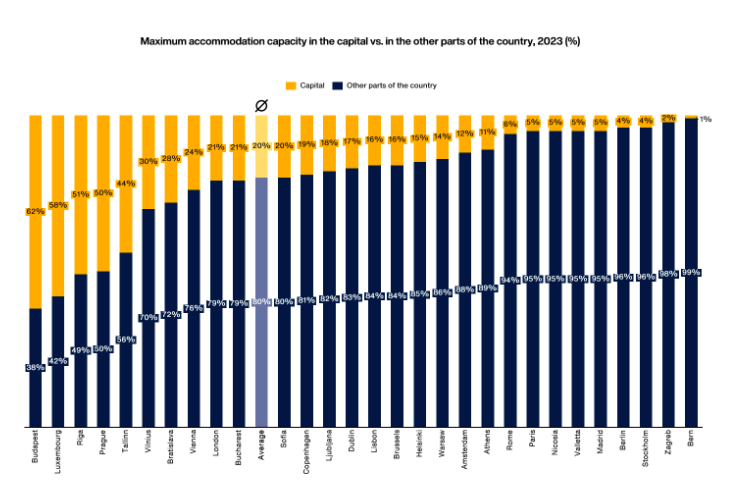

The distribution of accommodation capacity between capital cities and other parts of the country reveals notable differences. For example, Budapest accounts for 62% of Hungary's accommodation capacity, Luxembourg and Riga hold 58% and 51% of their respective countries' capacity.

In contrast, capitals such as Bern and Zagreb show a different trend. They have minimal shares of accommodation capacity (1-2%), suggesting a more decentralized tourism, whereas other destinations within these countries have developed strong tourism offers, distributing the flow of tourists more evenly and reducing the dependency on the capital city.

Other interesting examples are Paris and Rome, which generate 15% of France's STR revenue and 17% of Italy’s STR revenue while contributing 5% and 6% to the countries’ accommodation capacity respectively, indicating that despite their global reputation as tourist destinations, Paris and Rome have a relatively small share of the national accommodation capacity, suggesting that many tourists visiting France and Italy stay outside the capitals.

London in focus

It will come as no surprise that London is the most popular short-term rental destination in Europe. France is by far the biggest country, but London beats Paris in all the key metrics. Even though London shed a lot more rooms that Paris during the pandemic, losing 24% of capacity compared to 6%, London still generates the most room nights and the most money.

London saw an increase in revenue of 17% from 2019

Even though Londons occupancy is relatively low, under 40% it generated over 4.3 million overnights in 2023 creating revenue of 836 million euros. This marks an increase in revenue of over 17% from 2019 counteracting the decrease in available accommodation of 24% for the same period.

London stats

- € 837m revenue 2023

- 62k available beds 2023

- 24% decrease from 2019-2023

- 38% occupancy 2023

- 2% occupancy increase vs 2019

- €158 average rate

- 52% increase from 2019

- €1,785 Monthly revenue 2023

- 60% increase from 2019

Regulation is needed

Regulation is needed. The data calls for a critical reassessment of how European countries are managing their STR markets. The rapid revenue growth is promising, but it masks deep inequalities and potential sustainability issues

European countries must work with cities to develop tailored strategies that balance growth with sustainability. This includes implementing regulatory frameworks that address the specific needs of different markets, ensuring that the benefits of STRs are more evenly distributed, and preventing the kind of over-saturation that could lead to market collapse in vulnerable regions.

While the regulatory clampdown in certain capitals appears to address local concerns about overtourism and housing scarcity, the broader European trend reveals a more complex reality.

Top down? As the tourism industry continues to grow, it’s clear that cities cannot be left to manage this surge on their own. National-level regulation plays a crucial role, and it’s time for governments and administrations to step up.

It’s clear that cities cannot be left to manage this surge on their own

City solutions

Several European capitals have already implemented regulations to manage the STR market.

Barcelona banned the short-term rental of private rooms entirely in 2021, with restrictions on the number of days apartments can be rented per year. Paris has implemented restrictions in specific districts and Berlin limited STRs to a maximum of 60 days per year. Amsterdam requires STR hosts to obtain a permit and limits rentals to a specific number of days per year, and Vienna has recently tightened its rules, allowing hosts to rent out properties for a maximum of 90 days per year.

Turning up the heat

Some destinations and their local governments are more inclined to impose limits on tourism, especially if the negative effects of STRs outweigh the positive economic impacts, or if the destination is not solely reliant on the tourism industry and seeks to diversify its economy.

Nice problem to have

Of course there are many markets that would love to have the problems of Barcelona, Amsterdam and Dublin. Markets where STRs are underperforming, or barely present.

In terms of occupancy, there are some surprising names at the lower end of the table.

Scandinavian and Baltic countries mostly, Copenhagen, Vilnius, Bucharest, Helsinki and Tallinn all have really low rates as does Stockholm.

With less demand comes less rate and revenue with some destinations having rates in the €40-60 range.

Closing the door behind them

So did it work? Well, yes and no. Some markets have already had restrictions placed on the short-term rental market by local government. As you would expect, this turns out to be very good news for existing owners of this asset class.

STRs are becoming increasingly profitable

Of the three markets with the most stringent rules – Dublin, Amsterdam and Berlin, with the first two having the highest average rates in Europe. Dublins and Amsterdam have both grown the ADR dramatically. Only Berlin seems unable to take advantage of the constraints.

The first two markets have seriously constrained hotel numbers though. Amsterdam has had a moratorium on new hotel projects in the centre for a number of years and Dublin was using 20%+ of its room stock to house refugees. Berlin on the other hand, never met a hotel they didn’t like and have struggled with oversupply for years.

Ranking Table

City ranking

STR accommodation capacity

Density of STR supply per area

Density of STR supply per population

STR Overnights

Occupancy

Gross market revenue

Monthly revenue per available listing

Average Daily Rate

Rank

City

% Change

1

Luxembourg

1,752

2,199

25.51%

2

Warsaw

24,005

29,227

21.75%

3

Valletta

1,265

1,381

9.17%

4

Bucharest

16,059

16,828

4.79%

5

Bern

1,081

1,073

-0.74%

6

Vienna

36,092

34,788

-3.61%

7

Athens

40,476

39,011

-3.62%

8

Nicosia

1,817

1,739

-4.29%

9

Paris

138,557

130,124

-6.09%

10

Madrid

60,889

56,602

-7.04%

11

Sofia

10,276

9,327

-9.24%

12

Helsinki

10,291

8,996

-12.58%

13

Bratislava

6,213

5,105

-17.83%

14

Rome

96,750

79,406

-17.93%

15

Riga

9,739

7,893

-18.95%

16

Zagreb

12,517

10,130

-19.07%

17

Ljubljana

7,063

5,540

-21.56%

18

Brussels

18,871

14,404

-23.67%

19

London

212,303

161,737

-23.82%

20

Budapest

50,090

37,539

-25.06%

21

Lisbon

62,401

46,597

-25.33%

22

Copenhagen

45,964

32,689

-28.88%

23

Tallinn

9,977

6,863

-31.21%

24

Vilnius

8,506

5,516

-35.15%

25

Prague

45,755

25,968

-43.25%

26

Stockholm

9,692

5,316

-45.15%

27

Dublin

21,198

10,881

-48.67%

28

Berlin

43,887

21,029

-52.08%

29

Amsterdam

33,521

13,869

-58.63%

Implications

Balanced regulation – the key to sustainable tourism

While the regulatory clampdown in certain capitals appears to address local concerns about overtourism and housing scarcity, the broader European trend reveals a more complex reality.

Despite these efforts, overall STR supply across European capitals increased by 22% year-over-year from 2022 to 2023, outpacing the 12% growth in demand.

This suggests that regulation, in its current form, might be more of a band-aid than a long-term solution, as market dynamics continue to adapt and evolve, often outpacing policy responses

All of the data in the report was provided by AllTheRooms, with the exception of visitor numbers which were provided by GlobalData. All of the copy and analysis was done by Horwath HTL. Whereas all efforts have been made to verify the accuracy and validity of the data, and the data is believed to be accurate at time of publishing, this cannot be guaranteed. AllTheRooms and Horwath HTL reserve all rights.