Hospitality Insight

Turning Spas, Gyms and Retreats into profit centers

February 2026

Historically, spas and gyms were considered an “amenity” or a nice-to-have perk intended to elevate the brand perception or to fulfil the “star rating” requirement.

Today, the growing global emphasis in the post-COVID era on healthy lifestyles, work-life balance, mental wellbeing, and mindful living is driving increased spending on wellness services and retreat experiences.

As wellness rapidly evolves into one of the most lucrative segments in hospitality, the question for hotel developers and operators is no longer whether to include wellness facilities or not, but rather what to build, what scale, where’s the ROI, what’s a fad and what’s here to stay.

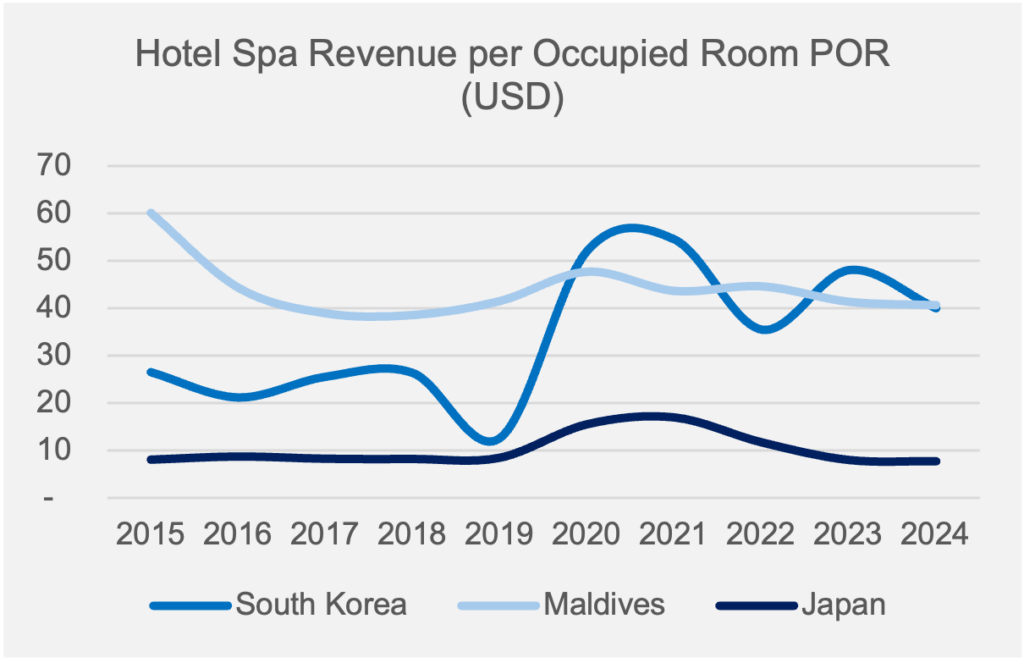

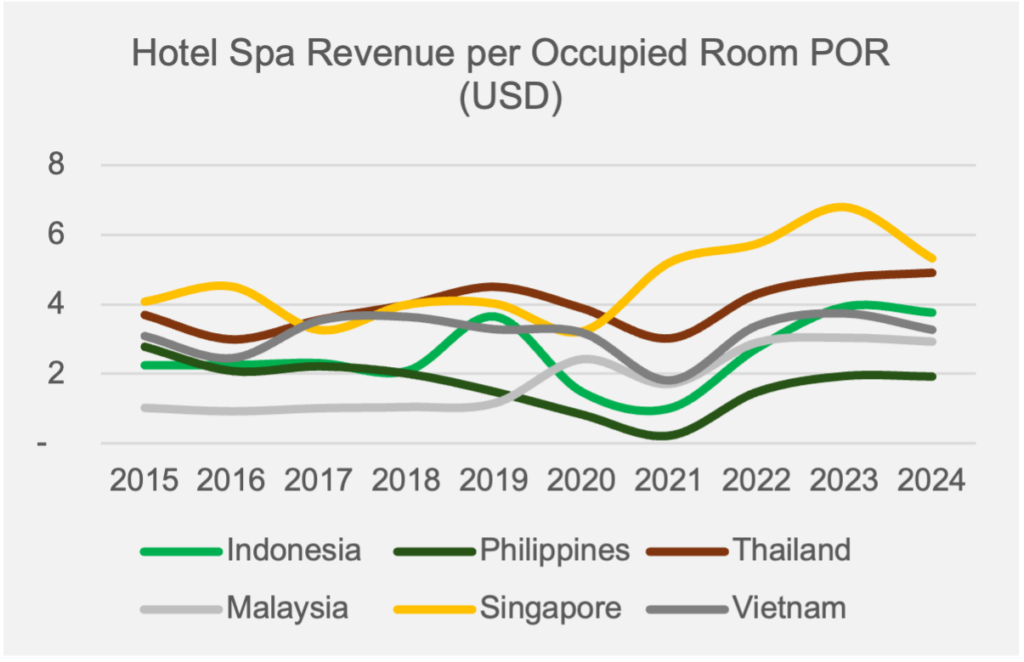

Source: Horwath HTL’s Annual Hotel Industry – Survey of Operations. The survey report publishes detailed, aggregated hotel industry performance statistics for key regional countries and markets.

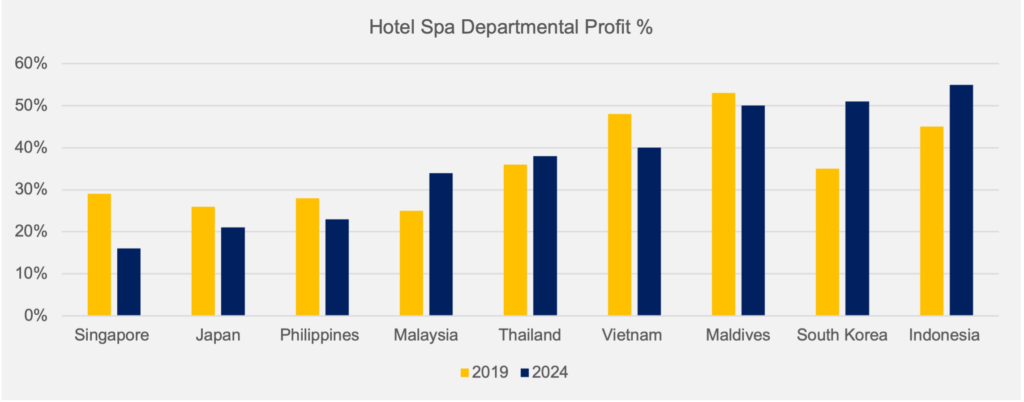

Source: Horwath HTL’s Annual Hotel Industry – Survey of Operations. The survey does not necessarily indicate significant changes in spa profitability for operating hotel properties, partly due to the time lag associated with wellness facility developments planned in 2023–2024 following the post-COVID shift in focus toward wellness. Horwath HTL will continue to monitor the performance trend of hotel spa across the region.

High-Margin Opportunities

- Health-tech amenities like cryotherapy, infrared sauna, which benefit from strong premium perception alongside low per-use costs following the initial equipment investment.

- Mind & body experiences such as sound therapy, salt room that requires limited staffing and / or support group participation.

- Multi-day wellness retreats or mindful stay packages that integrate dining and hotel activities to drive incremental spend.

- Spa retail with strong mark-up potential, e.g. wellness tea using locally grown ingredients, branded products.

Within the Asia Pacific region, wellness facilities are increasingly recognized as a core component of hotel operations.

This trend is evident in:

- rise of purpose-built wellness resorts in mature destinations, such as Gdas Bali,

- expanded spa offerings at family resorts, e.g. in Indigo / Holiday Inn Bintan where a dedicated wellness complex is under development,

- transformation of existing spaces into wellness sanctuaries within older urban hotels, with some of the best examples being The Sukhothai Bangkok with the new two-storey spa complex, Four Seasons Singapore launching the Chi Longevity Clinic, Mett Singapore with its soon-to-open The Longevity Suite that introduces a new level of advanced wellness,

- substantial allocation of gross floor area to wellness amenities in newer luxury properties such as Sindhorn Kempinski Hotel Bangkok and COMO Metropolitan Singapore, and inclusion of wellness facilities in new serviced apartment developments

When developing wellness programs, successful operators prioritize experiences that:

- deliver high perceived value,

- low variable costs,

- minimal consumables,

- short session duration,

- high repeat usage or membership potential, and

- ease of integration into wellness packages.

Moving beyond generic labour-intense spa treatments toward high-value wellness experiences is essential to improving profitability.

To counteract rising labour costs that pressure wellness margins, operators are urged to focus on cross-training staff to enable multi-service delivery and refining scheduling strategies to maximize staff utilization and minimize downtime. A well-trained, highly efficient team can create an exceptional guest experience and significantly lift margins.

Source: 2025 Horwath HTL’s Annual Hotel Industry – Survey of Operations

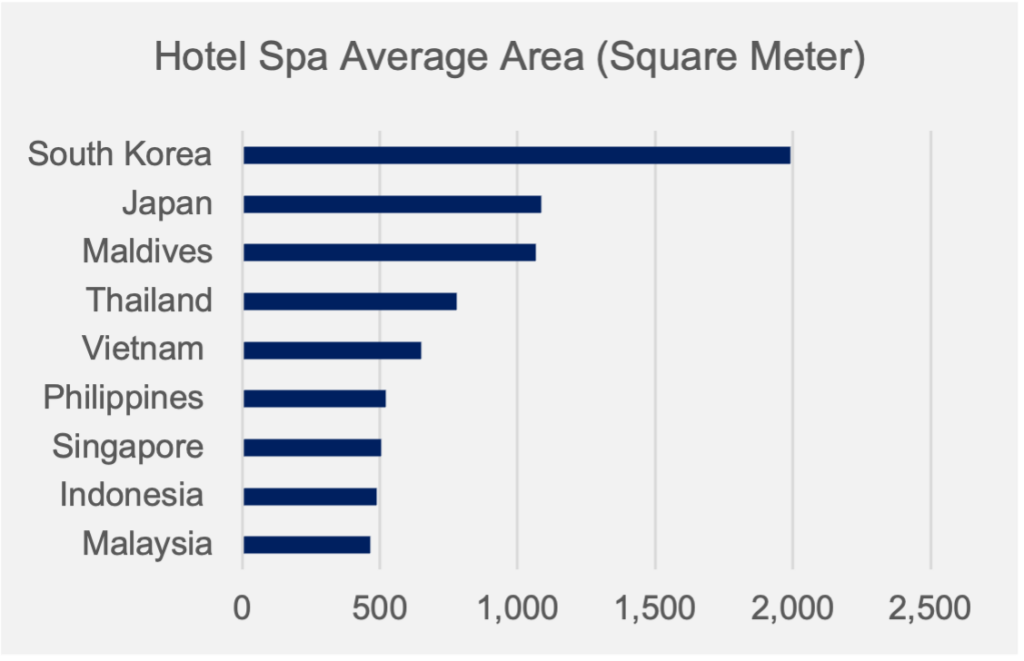

Hotel wellness spaces, including those in city locations, are not only expanding in size but also diversifying in response to the growing focus on holistic wellness.

Beyond traditional gyms and spa facilities, it has become common for hotels to provide dedicated mind & body spaces for meditation, breathwork, and emotional healing such as the unique sound healing area at the relaunched iconic Dusit Thani Bangkok and light sound vibration therapy at Desa Potato Head Bali, as well as active sports zones such as pickleball and padel courts that cater to shifting consumer interests across the region and have been more often found at hotel properties in destinations like Singapore (The Mett) and the Maldives (Soneva Fushi and Meyyafushi’s overwater Padel court).

We have also increasingly seen hotels introducing on-site organic farms, such as Centara Grand at CentralWorld Bangkok, W Bangkok and Conrad Koh Samui, as a means to strengthen brand positioning while integrating farm-to-table culinary experiences into their wellness offerings.

More recently, major city hotels like JW Marriott Tokyo have launched dedicated wellness room floors curating mindful guest experience throughout their stay, and we wonder whether this will evolve into a mainstream trend and a common room category in the near future.

As spa and wellness facilities are increasingly viewed as revenue generating assets rather than cost centres, we suggest that hotel operators and designers re-evaluate the design conventions that typically placed wellness spaces in less prime areas. Today, wellness spaces are expected to be afforded strategic locations, with examples such as seafront sauna and steam rooms at Risonare Kohama Island by Hoshino Resorts, yoga spaces designed as iconic, view-oriented features that create wellness environments closely connected to nature and the surrounding landscape.

The transformation of hotel wellness facilities from supporting amenities into strategic growth engines is reshaping how hotels are planned, operated, and positioned.

Whether hotel owners and operators can monetize their wellness offerings will depend on operators’ ability to curate high-value offerings, optimize operational efficiency, and integrate wellness into both the physical design and commercial strategy of the property. We look forward to seeing how evolving wellness demand will continue to unlock new revenue opportunities across the hospitality sector.