Hotel Portfolio Valuation

Key Service: Hotel Valuation

Location: Budapest, Hungary

Product: Asset Valuation for Refinancing

Office: Hungary

Overview:

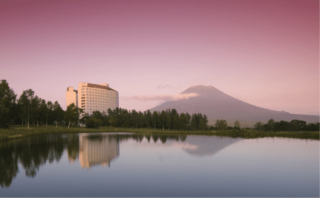

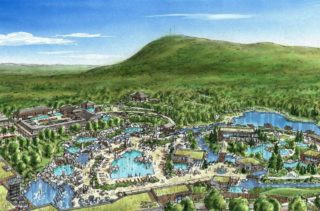

Horwath HTL Hungary was commissioned to value the 3-hotel portfolio of Zeina Hotels assessing the assets market value based on replacement cost, sales comparison and discounted cash flow approaches. We have also provided the bank with a mortgage value for each of the hotels. The valuation was carried out based on the RICS standards.

Scope of Work:

As part of the financing bank’s protocol, an annual valuation of the portfolio is required, for which Horwath HTL Hungary has provided market valuation services on multiple occasions.

Status: Project Completed in 2021-2022