Report

Bristol Hotel Market, Sept 2022

Market Recovery and Performance:

Bristol, the most populous city in southwest England, continues to attract both business and leisure travellers due to its vibrant creative media, electronics, and aerospace sectors. The city’s redeveloped centre and historical docks offer a rich cultural experience with numerous venues for performances, conferences, and events. Known for its culinary scene, Bristol was named the best culinary destination in the world in the 2019 Food Trekking Awards and was the European Green Capital in 2015.

Tourism and Visitor Profile

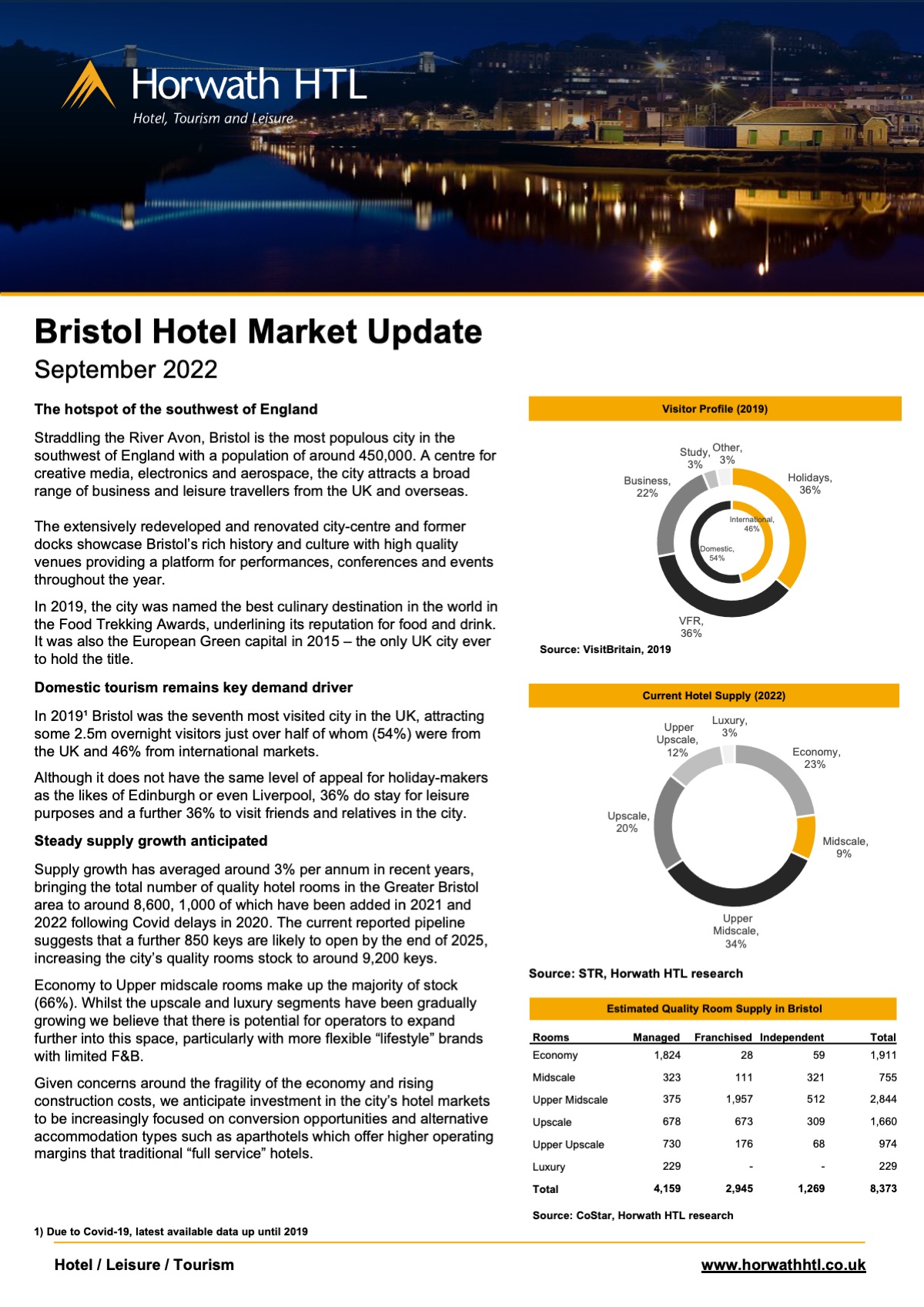

In 2019, Bristol was the seventh most visited city in the UK, drawing approximately 2.5 million overnight visitors, 54% of whom were domestic. The city is a key destination for leisure travellers (36%) and those visiting friends and relatives (36%).

Hotel Market Performance

- Occupancy and ADR: The market saw a turnaround from 2012 to 2017 but faced declines in occupancy and rates pre-pandemic due to new mid-market supply and reliance on lower-rated group business. While Average Daily Rate (ADR) rebounded strongly in 2021 and 2022, occupancy rates remained below 2019 levels as key business segments have not fully returned.

- Supply Growth: The supply of quality hotel rooms in Greater Bristol has grown by around 3% annually, with 1,000 new rooms added in 2021 and 2022. A further 850 keys are expected by the end of 2025, increasing the total to approximately 8,100 rooms. The majority of the current stock (66%) comprises economy to upper midscale rooms, with potential for expansion in the upscale and luxury segments.

Investment and Development

- Future Projects: Infrastructure projects, such as the redevelopment of Temple Meads station, the new YTL Arena (due in 2023), and the proposed sports hall and convention centre at Ashton Gate Stadium, are expected to support long-term growth. Investment will likely focus on conversions and alternative accommodations like aparthotels, which offer higher margins.

- Economic Challenges: Rising construction costs and economic fragility may impact future investments, but Bristol’s strategic location and ongoing developments position it well for recovery.

Market Trends and Outlook

- RevPAR Trends: Despite post-pandemic challenges, ADR improvements highlight a resilient market adapting to new demand patterns. The Meet Bristol & Bath Convention Bureau’s efforts to boost the MICE (Meetings, Incentives, Conferences, and Exhibitions) sector are critical for recovery.

- Visitor Demand: With easy access to major UK regions, Bristol is poised to benefit from business and worker relocations from London, further boosting hotel demand.