LIVERPOOL Hotel Market – Sept 2022

By Andrew Reitmaier on September 28, 2022

The UK’s major city hotel markets have rebounded strongly since the depth of the Covid-pandemic, but each destination has its own unique challenges and opportunities.

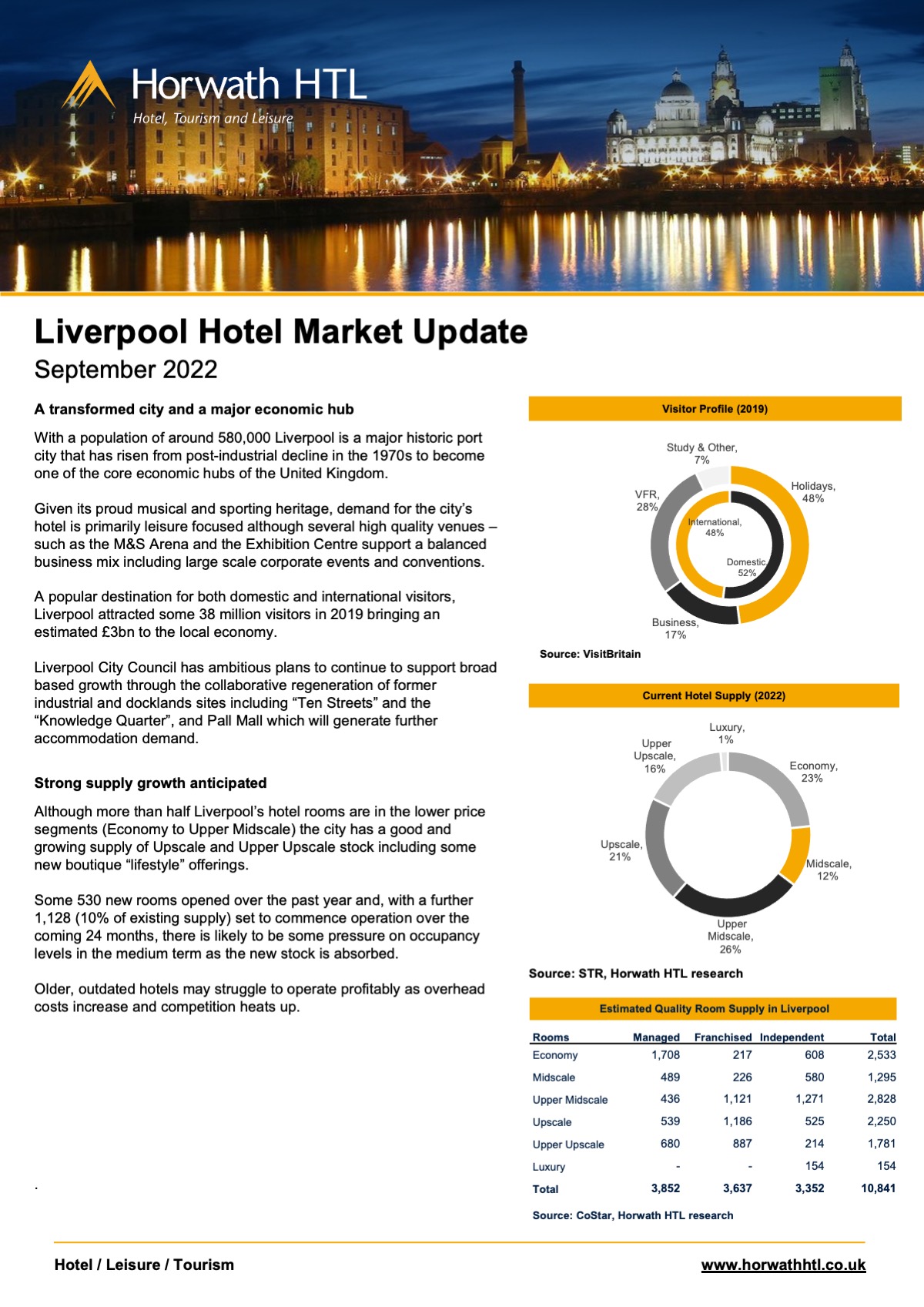

Liverpool has risen from post-industrial decline to become one of the core economic hubs of the UK renowned for its proud sporting and musical heritage.

Local government initiatives are supporting significant ongoing development of business and tourism facilities.

Although the long-term outlook for Liverpool’s hotel sector is positive, new, high quality supply, is likely to put significant pressure on existing hotels over the coming 2 to 3 years.

Horwath HTL constantly monitors hotel markets across the country and has prepared short updates on seven cities highlighting some common themes and unique characteristics influencing investment decisions in the sector. Our September updates include Birmingham, Greater Manchester, Edinburgh, Glasgow, Bristol, Liverpool and Cardiff.

In all the markets surveyed, average daily rates have exceeded pre-pandemic records despite occupancy levels generally lagging behind 2018 and 2019. Rate has been driven up by transient leisure demand, particularly around the return of major sports and cultural events, while traditionally lower rate group business has been more muted.

Substantial new supply has entered the market over the past year and the pipeline of new hotels in all markets remains robust and is likely to restrain occupancy rate growth in the short term. In the meantime Investors and operators are increasingly focused on value-add conversion opportunities – renovating existing hotels to improve market appeal and increase operating efficiency.

Expectations are that corporate and international travel (which have yet to recover to pre-pandemic levels) will continue to build back, however, concerns remain that rising costs and weakening consumer sentiment will soften demand and significantly erode profitability over the coming months.