Switzerland Hotels & Chains 2021

By Michaela Wehrle on May 7, 2021

“2020 was a year that shook the hotel industry to its core. It started with record figures and ended with the biggest financial crisis since the Second World War.” says Andreas Züllig, President of HotellerieSuisse.

The Swiss hotel market performs the best in Europe in 2020…

…. yet still contracted by more than half compared to 2019. In a year to forget for the global hotel market, Europe was the worst continent impacted by the COVID-19 crisis with an unprecedented 70% year-on-year reduction in RevPAR (as per local currency-denominated data recorded by STR). Switzerland’s hotels proved the most resilient in Europe with a relatively less robust decrease of 59% in RevPAR, which also pushed Switzerland to the number 1 spot in actual values (as per EUR denominated data recorded by STR).

Switzerland’s hotel market suffered acute demand and supply imbalance in 2020 with a 45% decrease in room nights with only an 11% decrease in rooms available, compared to 2019.

Not unexpectedly the dramatic drop in demand due to the COVID-19 crisis, coupled with a somewhat steadfast supply of hotels, creating an accentuated (but hopefully temporary) negative demand/supply disparity.

Nonetheless, this imbalance was not felt across the country with certain regions, predominately in Alpine areas, actually having more demand than supply.

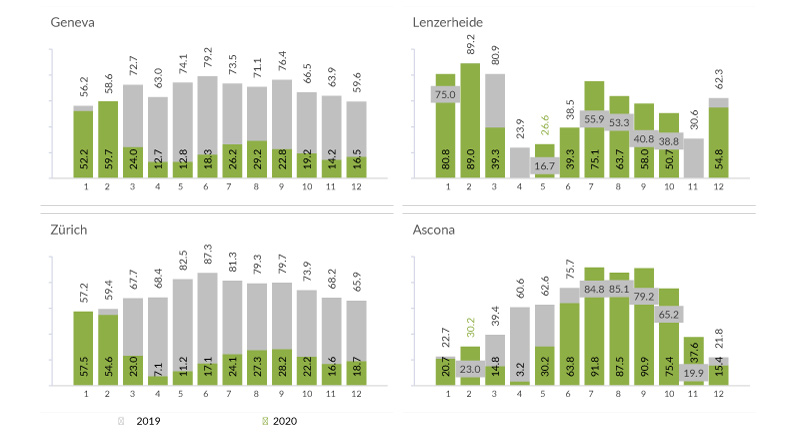

Cities across Switzerland suffered the most, with corporate and MICE segments the most impacted by COVID-19. Zürich and Geneva, the two most dependant regions on international arrivals, saw between 65% to 71% decreases in room nights. Hopefully, when international travel resumes, these cities bounce back well.

Seasonal Occupancy Samples – Gateway cities vs. Resort Destinations

(2020 over 2019)

Key Figures

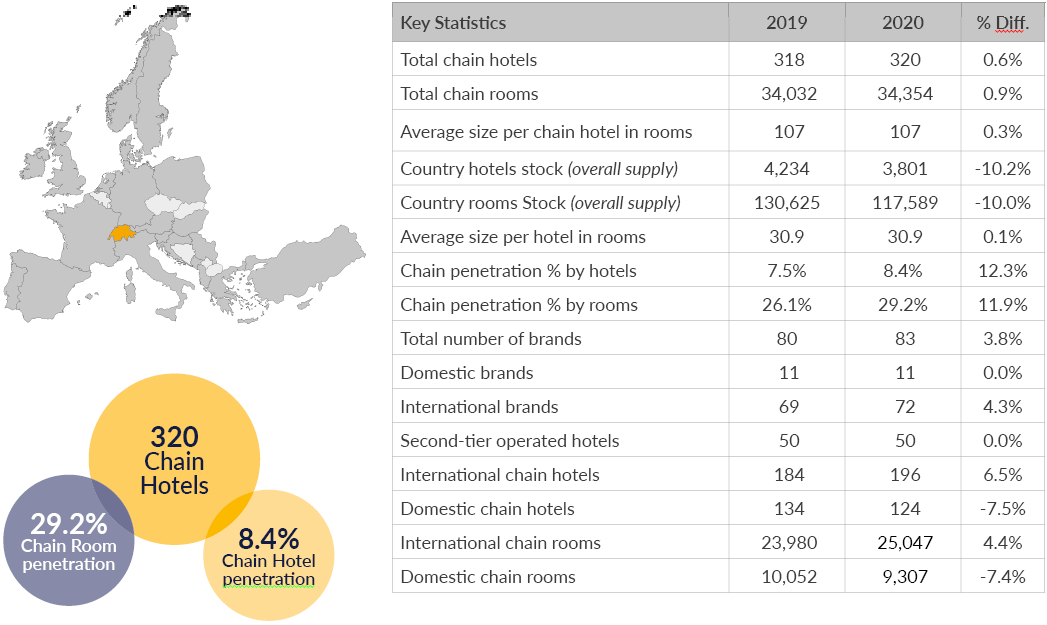

Hotel Chains

All groups with new openings in 2020 had already been present in Switzerland with one or more hotels in past year(s). Two thirds of the drop in the number of domestic chain hotels is owed to the fact that two groups missed our threshold of 5 hotels under operation this year and did not make the listing.

There was some movement in the international department as well with divestment, management back contracts, sold contracts and de-brandings.

Hotel Brands

In 2020, b_smart selection launched their new brand flexy.motel and Switzerland’s first prizeotel opened in Berne. In the luxury department, Fairmont took over the Geneva property from Kempinski.

Domestic white label operator SV Hotels developed their first own brand Stay Kooook – a serviced apartment concept that celebrated its first opening, also in Berne, this past year.

As many operators are still in negotiations with their lessors, and depending on the outcome of these negotiations, we expect to see some shifts in the Swiss brandscape in the years to come.

“Looking back in history we have seen many revivals of regions, destinations, and hotels and maybe Covid started a transition period which will give distinction to a new era in our sector. It will be a challenge for all of us but on the other hand will open new doors and possibilities for innovative and clever professionals.

We will experience the shifts not only in the different hotel segments and types of properties but also in the financing sector, and – last but not least – maybe also in guest behaviour and expectations” says Heinz Wehrle

The full report includes Regional, City and Destination market data in addition to a comprehensive overview of the chain hotel landscape for Switzerland. We consider the data presented herein as a snapshot per year-end of 2020. We will all have to wait and see how much damage the industry will have suffered once travel can resume and some kind of normalcy returns to the industry and our lives.

Have you read the previous reports in this series? Swiss Hotels & Chains 2020, 2019, 2018 and 2017.