European Chains & Hotels Report 2019

By James Chappell on March 4, 2019

A very warm welcome to the new edition of the Horwath HTL European Chains & Hotels Report, the third annual instalment. The report looks at the relationship between hotel chains, and their myriad of brands, and the wider world of hospitality and lodging. There have been two big stories over the last 25 years in the industry, and we look at them both in the report.

The first has been the inexorable growth and expansion of branded hotels and their wider significance in the landscape of hospitably. Every year sees the creation and introduction of more and more brands, both international and domestic, as a way to drive market share through identity, segmentation and increasing scale. This is being done in a variety of ways, either through the introduction of brands with a proven track record in other countries, the creation of new brands from scratch or the slicing and dicing of existing brands to make them go further.

The second large trend has been the change in the model for owning and operating hotels. What impact has this asset light approach had on growth? What is interesting, and a complicating factor, is how each market has a different tolerance for each model and how that can work for/against chains trying to sign more deals.

We look at the models used by the chain companies and see which ones are the most prevalent, in which market segment.

In this edition, we have enhanced the report in a number of key ways. Firstly, we have greatly expanded the scope of the markets, from 12 last year to 22 this. Our goal is to cover every market in Europe, and we are well on the way to achieving that. Secondly, we have added a lot of information about hotel ownership; who has been active buying and selling hotels, what were the biggest deals done last year and where is that money coming from (source Real Capital Analytics). Lastly, we have been able to identify and highlight where next years deals have been signed and when these new hotels are likely to open.

For the 12 markets where we have YoY data, there has been a significant amount of growth of Chain hotels in 2018. There was a total of 686 new hotels, equating to 73,802 rooms, which is just over 4% growth.

Total Market

For this edition of the report, we have collected data from 22 European countries, ten more than last year, and have year to year data from 12. This means a really fascinating spread from countries like Albania with 12 Chain hotels all the way to France with 3,885. The spread and the scale of the market is impressive, let’s start with some overall numbers. The market (22 countries) has a grand total of 146,616 hotels, which accounts for just over six million bedrooms. The average number of rooms per hotel in the market is 61, and range from a massive 238 in a resort destination like Cyprus, to 20 in Albania. Two of the largest markets, France and Spain, have a very disparate number with the average French hotel having just 36 rooms and the average Spanish hotel 94.

Chains

For the Chain Hotel market, there are 18,575 hotels with a total of 2,289,879 million bedrooms. This means that Chain hotels make up 13% of the overall hotel market, but represent 38% of the room market. Not surprisingly, the average size of Chain hotels is over twice the size of the whole market at 131 rooms. Here the spread is much more even, representing the consistency of hotel brands, with 19 out of the 22 markets having average chain room numbers of between 106 and 190.

Brands

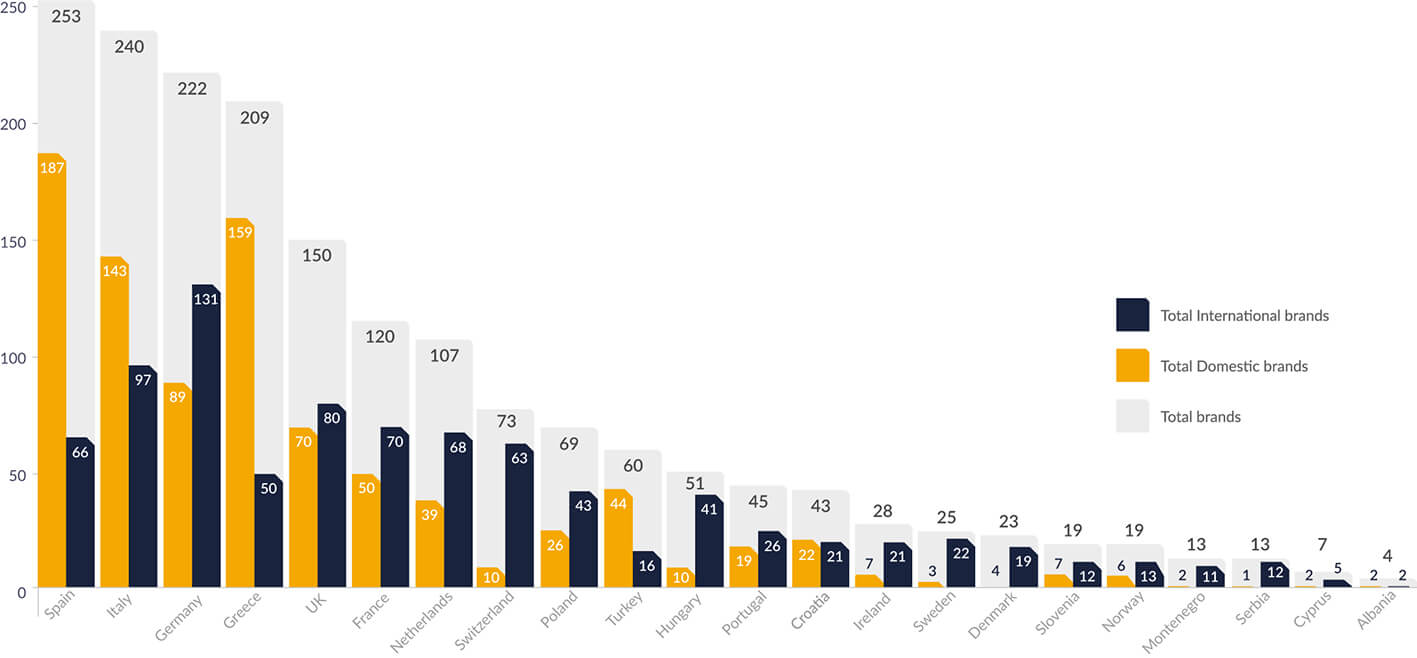

In terms of the total number of brands, the average country has 82 hotel brands present. This range goes from Albania with 4, to Spain with 253. Spain has the most domestic brands, 187, whilst Germany has the most International brands with 131.

Growth

For the 12 markets where we have year-on-year data, there has been a significant amount of growth of Chain hotels in 2018. There was a total of 686 new hotels, equating to 73,802 rooms which is just over 4% growth. In contrast, the overall market grew by less than 1%, meaning that if you take out new build hotels, the overall market probably lost more independent hotels than they gained. The total number of brands grew 7%, or 102. This doesn’t mean 102 new brands entered the market, but brands entered into markets they had not been in before.

All in all, it is a comprehensive look at a vibrant hotel market, one that has had significant growth over the last few years. We hope you enjoy reading the report as much as we enjoyed putting it together.

Also read the European Chains & Hotels Report 2018