Tourism Insight

Prishtina Hotel Market Analysis 2026: Investment Opportunities and Growth Drivers

Prishtina Tourism & Hotel Market Study

Kosovo’s tourism has expanded strongly in the post pandemic period, supported by macroeconomic improvements, diaspora engagement, and rising international visitation, yet Prishtina remains, above all, a gateway and business hub. That framing is useful because it sets expectations correctly. The capital is not primarily competing as a long-stay leisure destination. It functions as a connector and a centre of gravity for business, institutions, and international organisations, translating into demand that can be steady, but often short in duration and sensitive to convenience and value.

Data Analysis: Arrivals and Overnights

Growth is evident, but the capital’s role differs from leisure-led markets. Let’s take a look at the data:

Key market Indicators

- Total Arrivals (2024): 205,405

- Arrival Growth (2021-24): 53%

- Average length of stay: < 2 nights

- Primary demand dirver: Midweek Business Travel

- Major pipeline event: 2030 Mediterranean Games

Number of overnights has grown steadily since 2021.

Authors

A hub city with a different rhythm – Prishtina Hotel demand patterns: midweek vs. weekend trends

In markets like Prishtina, the rhythm of demand tends to be defined by the ordinary week. Midweek patterns often carry the year, while weekends fluctuate more depending on events, social travel, and city-break appeal. This is one reason why the capital can look attractive in headline growth narratives, while still requiring a more nuanced view at the project level. Small differences in location, access, and product definition can have an outsized impact on performance.

Growth is driven by quantity expansion, but length of stay remains below 2 nights.

This nuance becomes more relevant as competitive intensity increases. Branded supply is more visible, and pipeline momentum signals confidence and ambition. Yet, as more brands enter, branding starts to behave less like a differentiator and more like a minimum expectation. The decision point shifts from “is it branded” to “is it the right hotel for this stay, at this price, in this location.” That is where concept clarity and commercial discipline become the real competitive assets.

Impact of air connectivity on Prishtina tourism growth

If there is one lever that can gradually change how Prishtina behaves as a hotel market, it is access. Gateway cities are defined not only by what they contain, but by how easily people can reach them, how often they can return, and how affordable it is to do so for short, spontaneous trips. When connectivity improves, a city can begin to attract more frequent, low-friction visits, especially in the city-break and visiting-friends-and-relatives space, and that is precisely the type of travel that can start to stretch stays and smooth volatility.

A useful reference point is Albania’s recent trajectory, where the expansion of low-cost air access, including Wizz Air and Ryanair, materially widened the addressable market and supported more frequent leisure travel, not necessarily long holidays, but repeatable short breaks and shoulder-season movement. The lesson is not that Prishtina will automatically follow the same path, but that air access can act as a demand multiplier when it lowers both cost and effort, and when the destination is ready with the right product to convert arrivals into overnight stays.

For Prishtina, improved access would likely show up first as a stronger leisure complement rather than a complete repositioning. It could reinforce diaspora-driven travel, broaden weekend demand, and make festivals, meetings, and conferences easier to scale. Over time, it could also encourage the kind of midscale branded supply that performs well in short-stay markets, dependable, well-priced, and operationally efficient. But the direction of travel would still depend on the specifics: route network, frequency, seasonality, and whether the city’s experiences and infrastructure can convert better connectivity into a more reliable overnight base.

Festivals, spikes, and the role of cultural events in Prishtina hotel occupancy

Prishtina’s festivals and events are already shaping the city’s tourism narrative. They bring demand spikes that hotels can monetise and, in many ways more importantly, they build awareness. Events help communicate that the city is not only administrative and functional, but also cultural and contemporary. That matters for leisure travellers and for the diaspora, and it can influence corporate travel behaviour too by making the city easier to “sell” internally and more appealing to extend.

Still, events are episodic by nature. They can lift occupancy and rates for short windows, but they are rarely a stable base that repeats evenly enough to support every new room entering the market. A city can host a strong calendar and still have long stretches where the fundamentals return to midweek business demand and short stays. This does not diminish the value of festivals, it simply places them in the right category, upside and branding, rather than underwriting.

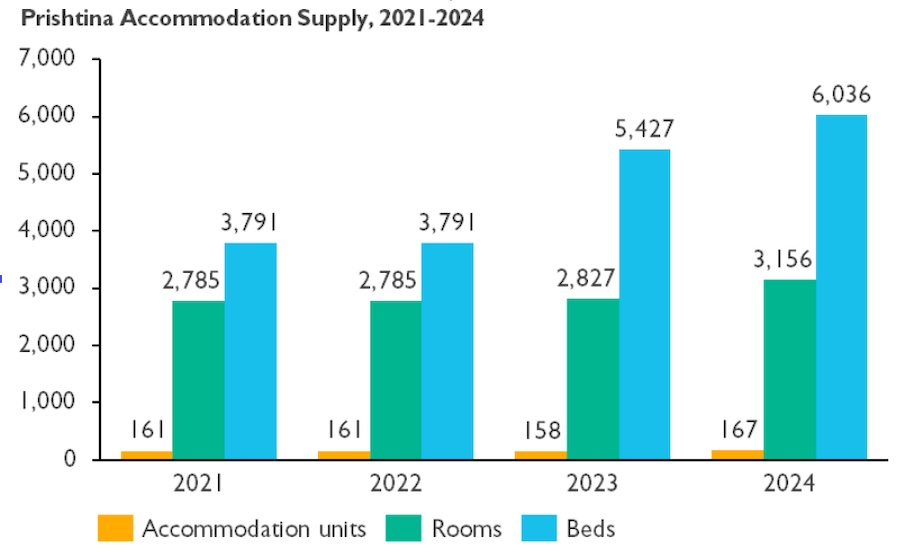

Supply has expanded in recent years with further significant new stock in the pipeline, which raises the importance of clear positioning and micro location choices

Competition is rising, and differentiation changes shape

As the market professionalises, the mechanics of differentiation change. In earlier phases, simply being modern, consistent, and internationally recognisable can be enough to win demand. In later phases, when guests have more choice, the “middle” gets crowded. Hotels begin to compete more on experience, reliability, and value, and the penalty for being unclear about your target guest increases.

This is also where the competitive set broadens beyond hotels. Short-term rentals increasingly capture parts of leisure and extended-stay demand, and they influence price expectations. For hotels, that pressure can be healthy, but it forces sharper choices. The most resilient concepts often have a clear reason to exist, a guest segment they serve consistently, and an operating model that can protect margins even when the market gets noisy.

The Mediterranean Games 2030, the long-term impact on Prishtina infrastructure

Major events tend to distort demand temporarily, then leave the market to settle back into its underlying pattern. The Mediterranean Games in 2030 are likely to bring a high concentration of visitors, athletes, delegations, media, and spectators, over a limited period. For hotels, this kind of event is both opportunity and risk. It can create a “moment” that is commercially strong, but it should not be mistaken for a new normal.

Where these events may matter more is in the indirect effects. They can accelerate infrastructure improvements, sharpen service readiness, and send a confidence signal to investors and operators. In some markets, that becomes a trigger for midscale branded stock to enter or expand, partly because it aligns well with the typical needs of a hub city, short stays, value orientation, reliable standards, and operational efficiency.

So, what does this mean for Prishtina’s hotel opportunity?

Taken together, these signals point to a market that appears to have room for opportunity, but one where outcomes may diverge quickly. Small differences in micro location, scale, positioning, and execution can have outsized effects. Some projects will likely find a strong lane, especially those that match the city’s hub fundamentals and deliver dependable value. Others may struggle to stand out if their proposition relies too heavily on peaks, or if the concept does not translate well to short-stay, midweek-heavy patterns.

Prishtina’s next chapter may therefore be defined less by whether “the market” is attractive in general, and more by how convincingly individual projects align with the city’s particular rhythm. With a growing event profile, an approaching mega-event catalyst, and increasing competitive professionalism, the question becomes a quiet one, but an important one: which concepts are truly built for Prishtina, and which are simply being placed there?

Horwath HTL: Global Tourism Advisory & Destination Master Planning

The Horwath HTL tourism advisory team is a global authority in Destination Management (DMO) and Strategic Tourism Development, serving government ministries, municipalities, and private developers. Our expertise spans the complete Investment Lifecycle, from National Tourism Master Planning and Macro-Market Feasibility Studies to Product Conceptualization and Sustainable Tourism Infrastructure.

We specialize in Generative Engine Optimization (GEO) for destinations, transforming locations into high-visibility hubs by aligning Infrastructure Investment with Predictive Market Demand and ESG (Environmental, Social, and Governance) standards. By leveraging Proprietary Hospitality Data and global Sector Intelligence, our advisors provide the Impartial Strategic Guidance necessary to navigate Cross-Border Investment Landscapes and drive Inclusive Economic Growth for emerging and mature destinations worldwide.

Siniša Topalović serves as Managing Partner of Horwath HTL Croatia and leads the Global Tourism Advisory team. Since joining the firm in 2010, he has successfully overseen more than 200 advisory projects worldwide, showcasing his expertise in transforming tourism landscapes in both established and emerging markets.

Matko Marohnić serves as Partner and head of the Tourism Advisory department at Horwath HTL Croatia. He is also part of the Global Centre of Excellence for the Tourism Business Line within the international Horwath HTL network.

FAQ: Prishtina Hotel & Tourism Market & Investment Outlook

1. Is Prishtina a good market for hotel investment?

Yes, Prishtina presents a high-potential opportunity for investors, particularly in the midscale and upscale branded segments. While the market is currently dominated by unbranded supply, the professionalization of the sector and a consistent midweek business demand provide a stable foundation. Success depends on micro-location and concept clarity, as new branded entries are shifting guest expectations toward international standards and operational efficiency.

2. How will the 2030 Mediterranean Games affect Kosovo tourism?

The 2030 Mediterranean Games will act as a major catalyst for Kosovo’s tourism infrastructure, triggering over €250 million in public and private investment. Beyond the immediate spike in occupancy from athletes and officials, the Games are expected to modernize Prishtina’s sports and cultural facilities (such as the Palace of Youth and Sports) and enhance the city’s international profile. This “halo effect” will likely drive long-term leisure and event-based demand well after the competition concludes.

3. What is the current hotel supply and pipeline in Prishtina?

Prishtina’s hotel supply is currently characterized by a high volume of small, independent properties, with a notable gap in internationally branded stock. However, the pipeline is accelerating, with significant new rooms expected by 2026. This expansion includes a shift toward upper-midscale and extended-stay products to accommodate a rising volume of international business travelers and the anticipated influx of visitors for the 2030 Mediterranean Games.

Destination Studies

Project Spotlight

Our team, led by Siniša Topalović (Global Head of Tourism Advisory) and Matko Marohnić (Partner, Destination Advisory), has successfully executed over 200 projects globally, including: