Hospitality Update

Awakening Horizons: Hotel Market Update for Kota Kinabalu, the Land below the Wind

December 2025

Nestled on the shores of the South China Sea, Kota Kinabalu (KK) in Malaysia continues to captivate travelers with its unique blend of pristine islands, lush rainforests, and vibrant cultural heritage. The city serves as a gateway to Borneo's unparalleled natural wonders, making it a highly sought-after destination for both leisure and adventure travelers.

In this report, we will explore some exciting updates and the current outlook for the hotel and tourism market in Kota Kinabalu, reflecting the dynamic and evolving landscape of the region.

Limited Flight connectivity restricted tourist arrival rebound, 2025 YTD figures look promising

Tourist Arrivals to Sabah, 2015 – 2025 YTD Sept

| Year | International Tourists | % change | Domestic Tourists | % change |

| 2015 | 978,425 | – | 2,197,800 | – |

| 2016 | 1,128,776 | 15% | 2,299,132 | 5% |

| 2017 | 1,235,178 | 9% | 2,449,556 | 7% |

| 2018 | 1,361,567 | 10% | 2,517,846 | 3% |

| 2019 | 1,469,475 | 8% | 2,726,428 | 8% |

| 2020 | 180,286 | -88% | 797,176 | -71% |

| 2021 | 7,286 | -96% | 363,901 | -54% |

| 2022 | 280,101 | 3744% | 1,447,639 | 298% |

| 2023 | 858,475 | 207% | 1,754,797 | 21% |

| 2024 | 1,264,548 | 47% | 1,882,932 | 7% |

| 2024 YTD Sept | 991,629 | – | 1,424,502 | – |

| 2025 YTD Sept | 1,162,459 | 17% | 1,663,931 | 17% |

| CAAG (‘15-’24) | 3% | – | -2% | – |

| 2024 vs 2019 | -14% | – | -31% | – |

Source: Sabah Tourism Board

International arrivals in 2024 remain 14% lower than 2019, while domestic tourist figures had not returned to above 2 million, remaining 31% below 2019 levels.

One contributing factor was reduced flight connectivity. The total number of weekly international direct flights to KK was around 130 as of November 2025, which was 39% below the 2019 figures. Although new routes to Ho Chi Minh City and Jakarta have been introduced in recent years, KK still lacks direct flight connectivity from medium to long-haul source markets such as Australia, the US, and Europe. Nonetheless, 2025 YTD figures look positive, both international and domestic tourists recording double-digit growth as compared to the same period in 2024.

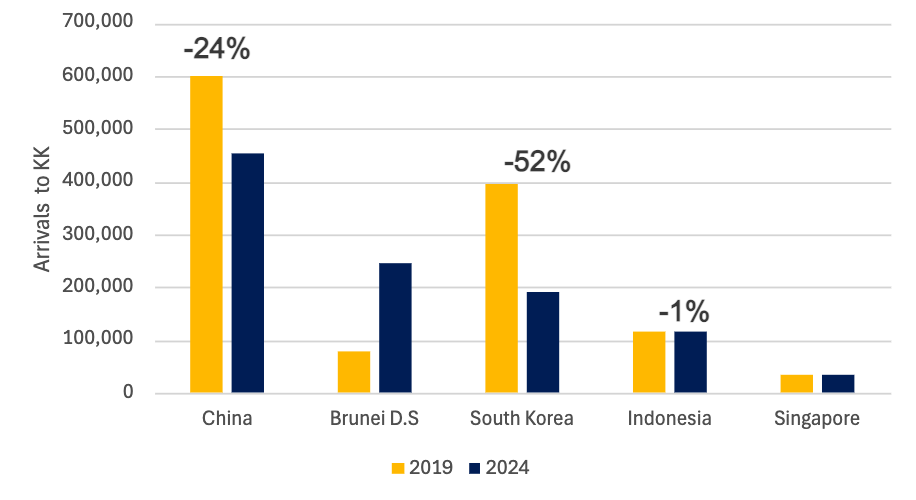

China remained the top market, while Brunei D.S overtook South Korea as second place

Top 5 Source Countries of International Arrivals to Sabah (2024 v.s. 2019)

Source: Sabah Tourism Board

Source: Sabah Tourism Board

China has consistently remained Sabah’s leading international source market for tourist arrivals. Although the number of visitors from China declined by 24% in 2024 compared to pre-pandemic levels in 2019, there was a notable rebound in 2025. By September 2025, arrivals from China had already surpassed 534,000, exceeding the total Chinese arrivals recorded for the entire year of 2024.

In contrast, South Korea, which previously held the position as Sabah’s second-largest source market, experienced a drop in ranking and became the third-largest in 2024.

Among Sabah’s top five international source markets, only Brunei D.S and Singapore demonstrated positive growth between 2019 and 2024. Notably, tourist arrivals from Brunei D.S more than doubled during this period, establishing Brunei D.S as Sabah’s second-largest source market. One significant factor contributing to this surge was the completion of the Temburong Bridge in 2020, which reduced travel time between Brunei D.S and Sabah, thereby enhancing accessibility and encouraging more cross-border visits.

Singapore Office

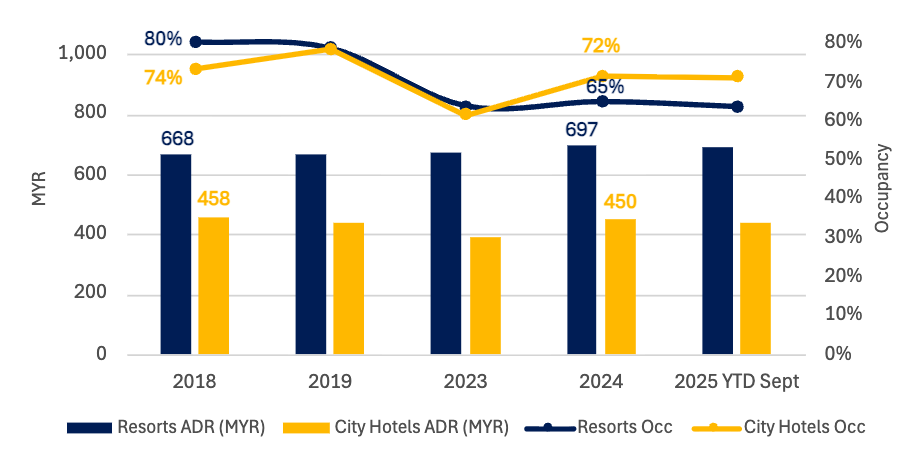

KK Upper-upscale Hotel Performance – Declining RevPAR for both Resorts and City Hotels

Between 2018 and 2024, RevPAR (Revenue Per Available Room) for upper-upscale resorts and city hotels in KK decreased at compound annual average growth rates of 3% and 1%, respectively. Despite modest room rate growth at a CAAG of 1%, demand for resorts in KK declined significantly during this period, with market occupancy dropping from 80% in 2018 to 65% in 2024.

Contributing factors include reduced tourist arrivals and a lack of new resort developments, as the most recent branded upper-upscale resort opened nearly thirty years ago. Conversely, city hotels have witnessed several new openings, such as the Kota Kinabalu Marriott Hotel and Hyatt Centric Kota Kinabalu. Nonetheless, these properties continue to face stagnant demand growth, with market occupancy falling from 74% prior to the pandemic to 72% in 2024, while ADR registered a slight decline of 0.3%.

| Daily Room Night Available | RevPAR | |||

| Resorts | City Hotels | Resorts | City Hotels | |

| 2018 | 1,444 | 1,670 | 537 | 337 |

| 2019 | 1,444 | 1,836 | 525 | 345 |

| 2023 | 1,444 | 2,058 | 430 | 241 |

| 2024 | 1,444 | 2,058 | 453 | 323 |

| 2025 YTD Sept | 1,444 | 2,058 | 441 | 315 |

| CAAG (’18-’24) | 0% | 4% | -3% | -1% |

Source: Horwath HTL

Optimistic Outlook for KK Hotel Market

Looking forward, we are optimistic about Kota Kinabalu’s hotel and tourism landscape, for the following reasons:

- Land below the Wind: Sabah’s geographical position just south of the cyclone belt in the western Pacific, keeping it outside the dangerous typhoon belt, giving it historical significance as a safe, storm-protected region. Safety is becoming an increasingly important factor in choosing travel destinations as natural disasters grow more frequent worldwide. KK’s status as a safe destination would be key to attract both leisure and business travellers.

- Expansion of Kota Kinabalu International Airport (KKIA): A budget of RM 442 million was approved in November 2024 for the airport’s expansion. This project aims to increase KKIA’s annual passenger capacity from 9 million to 12 million. Improvements include enlarging the main terminal, constructing a new multi-storey car park, adding seven aircraft parking bays, and upgrading surrounding roads. The expansion is set to begin in Q3 2025 and is expected to be completed by 2028.

- New infrastructure improvements and mixed-use projects to enhance the overall appeal of Kota Kinabalu: Major mixed-use developments and urban infrastructure improvements, such as the new Tourist Jetty and various waterfront mixed-use developments, will enhance the visitor experience, helping to attract repeat travellers and increase the average length of stay.

- Major Renovation of existing resort: Shangri-La Tanjung Aru has started its major renovation in October 2025. The renovation is expected to take around 18 months, covering the Main Lobby and half of its room inventory, and new addition of facilities including a new pool, a new Western grill restaurant, new family facilities, etc.

- Induced demand from new branded resorts and city hotels: Several well-known names such as Sheraton Kota Kinabalu, Avani Kota Kinabalu, Club Med Borneo, the InterContinental Kota Kinabalu, Hilton Tuaran Resort, are set to open in Kota Kinabalu within the near term. These new branded and upscale properties are anticipated to draw more affluent travellers, both domestic and international. Furthermore, the extensive global marketing efforts of these hotel brands will enhance KK’s visibility in international markets, boosting tourism demand and increasing visitor expenditure.

Artistic Rendering of the newly renovated main lobby at Shangri-La Tanjung Aru.

Artistic Rendering of the newly renovated main lobby at Shangri-La Tanjung Aru.

Source: https://www.shangri-la.com/en/landing/tanjungaru-updates/

Artistic Rendering of the InterContinental Kota Kinabalu

Artistic Rendering of the InterContinental Kota Kinabalu

Source: https://www.ihgplc.com/en/news-and-media/news-releases/2023/ihg-and-zhancheng-tourism-development-announce-eco-friendly-ic-sabah-kota-kinabalu-resort

Artistic Rendering of the Club Med Borneo Guestroom

Artistic Rendering of the Club Med Borneo Guestroom

Source: https://www.clubmed.com.sg/l/club-med-borneo-kota-kinabalu-malaysia

Summary

The outlook for KK’s hotel market remains optimistic. With Kota Kinabalu’s robust tourism fundamentals, including its status as “the land below the wind,” world-class natural attractions, and rich cultural heritage, the current challenges of limited connectivity and slow demand growth are anticipated to be addressed in the near term. This improvement is expected through increased capacity at the Kota Kinabalu International Airport, continual upgrades to existing properties, and the introduction of new and exciting hotel and resort offerings.