Introduction

The substantial expansion of the short-term rental (STR) market, driven by online booking platforms has faced significant backlash in recent years.

This is especially true in traditionally tourism-focused destinations, where the uncontrolled growth of STRs imposes increasing challenges in environmental, social and economic contexts. Consequently, managing STR’s growth has become a widely discussed topic among governments and destination managers who seek solutions to minimise the unquestionable negative effects.

The first step in developing effective management strategies for STRs is to measure their current state through revenues, supply and demand.

בת זוג

Short-Term Rental Analytics & Data

Liftoff

At the country level, the financial performance of the STR market showed growth across all indicators.

Gross revenue surged from EUR 11.8 billion in 2019 to EUR20.3 billion in 2023, marking a 72% increase.

2023 room rates are 50% higher that in 2019.

The five largest markets – France, the UK, Italy, Spain, and Germany – collectively accounted for 74% of the total STR revenue in 2023 in Europe.

Just 10 countries, out of 27 measured here, generate 90% of the revenue.

Revenue in France grew 93% between 2019 and 2023. In the same period Italy 87%, Spain 72% and UK 56%.

Even Germany with some of the strictest legislation grew 32%.

Revenue has almost doubled since 2019

In 2023, available beds across Europe’s nations ranged from a mere 3,000 to over 2 million.

France, with 2.67 million beds, dominates the scene, nearly doubling the STR capacity of Italy and quadrupling that of Croatia.

Supply is still recovering from Covid

Occupancy was higher in 2022 than 2023.

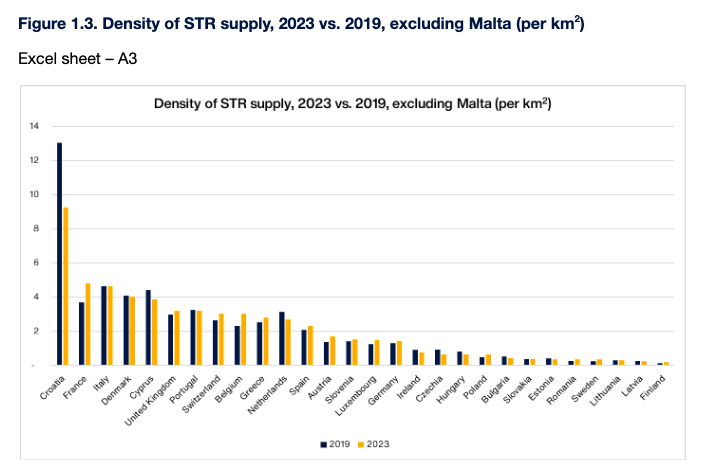

Croatia has constantly led the pack in density per capita and, although the decrease between 2019 and 2023 in density is visible, this is contributed to still recovering supply from the influence of pandemic.

France Gross Revenue 2023

Portugal Change in Monthly Revenue 2019-2023

Croatian ADR Increase 2019-2023

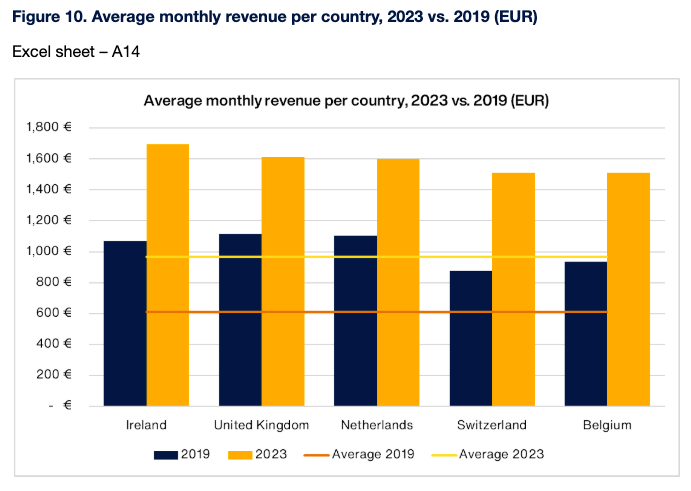

Average Monthly Revenue

STRs continue to be a lucrative business and investment opportunity

The attractiveness of operating STRs is further highlighted by the rise in average monthly revenue per available listing (RevPAL).

This metric jumped from EUR 611 in 2019 to EUR 965 in 2023, signalling strong demand for these properties across Europe.

Supply

Occupancy rates on the rise

The majority of analysed countries saw a rise in occupancy from 2019 to 2023, with only eight countries experiencing a decline. Estonia had the most significant decrease (-21%), while other drops ranged from -5% to -1%. Interestingly, occupancy rates were generally higher across the board in 2022, with just three countries exceeding their 2022 occupancy in 2023.

This decline in 2023 can potentially be attributed to an influx of new STRs entering the market, outpacing the growth in overnight.

Back in 2019, Belgium (39.3%), Luxembourg, (37.4%) and the UK (35.6%) were leading. But by 2023, Malta had surged to the top, boasting a 44.2% occupancy rate, while Belgium and Luxembourg still performed strongly at 39.7% and 38.0%, respectively.

Demand

Demand surges 20% since 2019

The European STR market has seen a significant surge in demand over recent years, reflecting the growing appeal of this accommodation option. In 2019, STRs across the region recorded a robust 140.3 million overnight stays.

By 2023, this figure had jumped nearly 20% to 167.4 million overnights, marking a clear upward trend in traveller preferences.

Four countries dominate

France

– 29% share of supply

– 2.66m available beds

– 31% increase 19-23

– Density per area: 5

Italy

– 15% share of supply

– 1.4m available beds

– 0.17% increase 19-23

– Density per area: 5

Spain

– 13% share of supply

– 1.17m available beds

– 12.5% increase 19-23

– Density per area: 2

UK

– 8% share of supply

– 770k available beds

– 6.7% increase 19-23

– Density per area: 3

Movers and shakers

Overnights

– Romania +43%

– Finland +34%

– Greece +32%

– Poland +28%

Occupancy

– Cyprus +9%

– Malta +9%

– Portugal +8%

– Bulgaria +7%

2019-2023 change

Revenue

– Romania +195%

– Poland +141.61%

– France +92%%

– Greece +91%

ADR

– Hungary +99%

– Slovenia +96%%

– Romania +90.53%

– Lithuania +75%%

2019-2023 change

Malta Occupancy 2023

Romania revenue increase 2019-23

Hungary increase in ADR 2023

Space. The final frontier?

STR Supply Density

Elbow room

The overwhelming sense we get from the cities that are pushing back hardest is that there are overrun and there is no space. They may have a point, Venice in August anyone?

One of the key metrics to look at has to be density of supply. This is a basic calculation to show how many rentals there are in a certain area.

There are two measurements we look at, density per population and density per square kilometre. If we are looking for culprits that would explain the backlash against short-term rental rentals, is this a good place to start?

In many markets this number has gone down since 2019, although perhaps significantly, Spain is not one of them.

STR Ranking Table

European country STR data

STR accommodation capacity

Density of STR supply per area

Density of STR supply per population

STR Overnights

Occupancy

Gross market revenue

Monthly revenue per available listing

Average Daily Rate

דרגה

Country

% שינוי

1

Sweden

102,352

149,323

45.89%

2

Finland

43,307

61,061

41.00%

3

Poland

151,115

202,862

34.24%

4

France

2,029,459

2,666,078

31.37%

5

Belgium

70,774

92,265

30.37%

6

Romania

63,521

81,052

27.60%

7

Austria

115,615

142,886

23.59%

8

Luxembourg

3,188

3,823

19.92%

9

Switzerland

109,485

125,485

14.61%

10

Spain

1,047,875

1,179,746

12.58%

11

Germany

462,243

515,881

11.60%

12

Greece

325,581

358,181

10.01%

13

Slovenia

28,519

30,590

7.26%

14

United Kingdom

722,950

771,658

6.74%

15

Slovakia

17,740

18,428

3.88%

16

Italy

1,396,871

1,399,191

0.17%

17

Denmark

174,735

172,440

-1.31%

18

Portugal

298,452

292,091

-2.13%

19

Lithuania

19,214

18,598

-3.21%

20

Latvia

16,927

15,621

-7.72%

21

Cyprus

40,665

35,728

-12.14%

22

Malta

32,581

28,390

-12.86%

23

Netherlands

129,618

111,797

-13.75%

24

Estonia

18,134

15,440

-14.86%

25

Ireland

76,681

64,504

-15.88%

26

Bulgaria

58,415

46,710

-20.04%

27

Hungary

76,764

60,999

-20.54%

28

Czechia

72,571

52,186

-28.09%

29

Croatia

738,265

523,686

-29.07%

Overcrowding or Overtourism?

Conclusion

The narrative emerging from the European STR market is one of stark contrasts and looming challenges. The data reveals a market that is not just growing but evolving in ways that create clear winners and losers, both among countries and within their tourism sectors.

As the STR market surges, the real story lies in the uneven distribution of benefits and burdens, raising urgent questions about sustainability, regulation, and the future of European tourism.

The truth is of course very complicated, some cities like Paris have just become so used to tourists that the answer to every question seems to be more tourists. Is this because the infrastructure is better developed than other countries that are struggling? Hardly, but its very size and diversity of tourism product allows it to divert tourists to other areas.

We believe that this data shows the difference between overcrowding and over tourism is effective destination management. This means a combination of the right legislation, the right incentives but also embracing smart new technologies that help destination management organisations create sustainable tourism.

All of the data in the report was provided by AllTheRooms, with the exception of visitor numbers which were provided by GlobalData. All of the copy and analysis was done by Horwath HTL. Whereas all efforts have been made to verify the accuracy and validity of the data, and the data is believed to be accurate at time of publishing, this cannot be guaranteed. AllTheRooms and Horwath HTL reserve all rights.